Embarking on an accounting profession or advancing on this sector requires data of the completely different accounting job varieties. This text outlines the important thing roles from conventional to area of interest, equipping you with insights into their features, {qualifications}, and prospects. Delve into the essence of every accounting path and learn the way these roles contribute to the broader monetary {industry}.

Key Takeaways

- Accounting careers provide all kinds of roles past tax preparation, from forensic to authorities accounting, with a robust development outlook projecting 67,400 new jobs by 2032.

- Technological advances like automation, blockchain, and AI are revolutionizing accounting, growing effectivity and altering the character of accounting duties.

- Skilled improvement by means of persevering with training and certifications like Licensed Public Accountant (CPA) are necessary for profession development in accounting, and might garner bigger salaries.

Exploring the Panorama of Accounting Careers

Accounting extends past numbers, serving as an organized system for documenting enterprise and monetary actions. It includes:

- Summarizing monetary data

- Analyzing monetary data

- Verifying monetary paperwork

- Reporting monetary outcomes

- Making monetary forecasts

This course of is essential to producing priceless information for enterprise decision-making and regulatory compliance. The position of accountants in upholding monetary reporting integrity is essential. It types the premise for public belief and worth within the company sector. Such integrity is effective because it promotes transparency and reliability in companies and organizations.

The expansive and economically impactful accounting {industry} generated a outstanding $141 billion in income in 2022. This displays the very important position accountants play in sustaining the well being of the financial system. An enormous array of profession choices is on the market on this discipline, spanning from typical roles like monetary accountants and auditors to area of interest areas like forensic and authorities accounting. The median pay for accountants and auditors in 2023 was $79,880 per yr, making it a profitable career. Moreover, the everyday entry-level training for accountants and auditors is a bachelor’s diploma, which opens doorways to quite a few alternatives within the discipline.

The forecast for accountants and auditors from 2022 to 2032 is optimistic, projecting an employment development of 4%. This development emphasizes the necessity for accounting professionals, and the importance of accounting training in equipping people for a affluent profession on this discipline.

Varieties of Accounting Jobs & Specializations

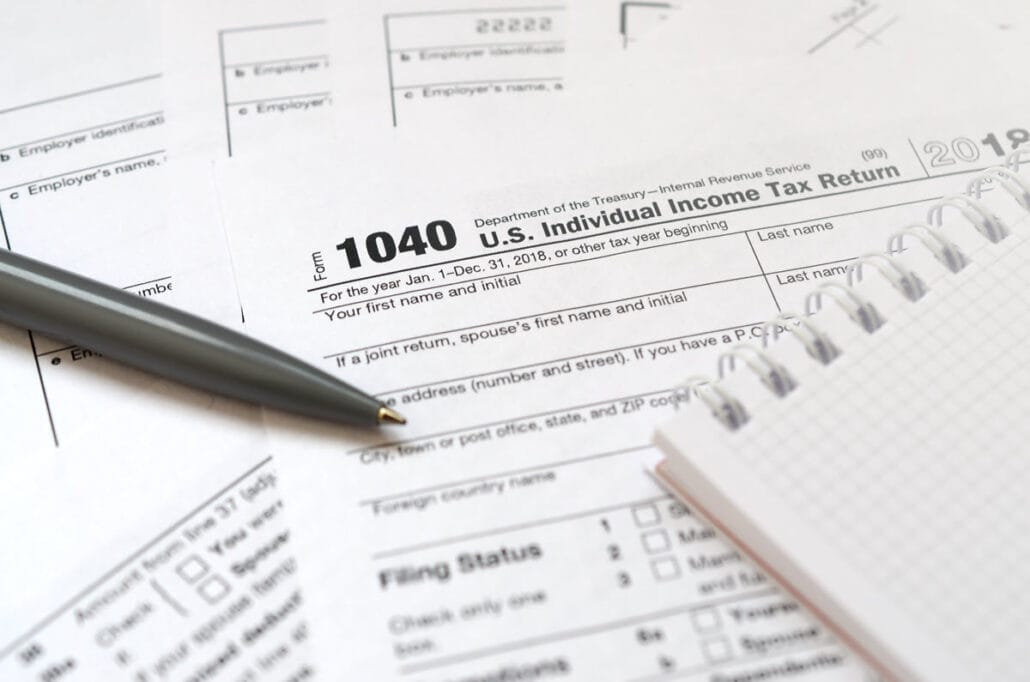

A standard false impression about accountants is their main position as tax preparers. Whereas being a tax accountant is a big a part of the career, there are numerous different specializations inside accounting.

Specializing in a specific space of accounting can enhance a person’s marketability, job safety, and incomes potential. Teamwork can also be extremely valued within the accounting discipline, the place success typically outcomes from collaborative efforts towards a shared goal.

Completely different pursuits and talent units discover their match within the various varieties of accounting specializations. A few of these specializations embody:

- Forensic accounting, which includes investigative work

- Authorities accounting, which focuses on public monetary administration

- Public accounting, which spans monetary reporting, advisory, and taxes

- Accounting data methods, which take care of monetary information

Every specialization necessitates a definite set of expertise and data, rendering the accounting career a assorted supply of jobs.

Monetary Accounting: The Spine of Enterprise Reporting

Monetary accounting, the core of enterprise and group reporting, consolidates data for monetary statements and studies meant for exterior customers. A monetary accountant ensures compliance with Typically Accepted Accounting Ideas (GAAP) within the U.S. and Worldwide Monetary Reporting Requirements (IFRS) for corporations working internationally. This compliance is essential for sustaining the integrity and transparency of economic studies, that are important for stakeholders’ belief.

Monetary accountants usually undertake duties associated to varied varieties of accounting inside a company, resembling:

- Normal ledger accounting

- Administration of accounts payable/receivable

- Payroll

- Grant administration

- Upkeep of fastened property

- Dealing with monetary paperwork and monetary data

- Compiling and reviewing monetary statements

These duties permit a monetary accountant to make sure that monetary information is precisely recorded and reported, offering a transparent image of an organization’s monetary well being. Monetary statements and studies generated by these accountants inform choices by buyers, regulators, and different exterior events, making monetary accounting a cornerstone of the enterprise world.

Administration Accounting: Steering Organizational Technique

By documenting and monitoring a company’s monetary planning for inner stakeholders, administration accountants play a pivotal position in guiding organizational technique. They make the most of historic efficiency evaluation to foretell future efficiency, aiding managers in decision-making to maximise profitability. This realm of accounting incorporates a mixture of monetary planning, evaluation, and strategic pondering.

Some roles in administration accounting have emerged, permitting small companies to outsource high-level duties and convey experience to the group that beforehand was not potential for them. The digital CFO (chief monetary officer) is an instance of the sort of place. A digital CFO oversees the accounting employees of different companies and displays their inner controls. They supply monetary assertion evaluation, projections, strategic planning, compliance, money circulate administration, and tax planning. Digital CFO’s are extremely expert at discovering weaknesss in each accounting practices and in operations that have an effect on the expansion of a enterprise. This enterprise champion designation can result in great job satisfaction.

Value accountants, a subset of administration accountants, are accountable for:

- Documenting and presenting manufacturing prices

- Controlling variable and glued prices

- Managing how prices are monitored inside the manufacturing course of

- Allocating departmental prices and overhead

- Assessing the true value of an worker, permitting for the comparability of worker value versus the income they generate

The data offered by administration accountants is prime for strategic enterprise planning and management, guaranteeing that assets are used effectively and successfully.

Forensic Accounting: Unraveling Monetary Puzzles

Forensic accounting is an intriguing discipline, involving investigations into fraud and embezzlement circumstances to completely account for all transactions in monetary data. A forensic accountant is commonly referred to as upon to construct circumstances towards accused events and testify as an professional witness in court docket, leveraging their specialised data and findings. Forensic accounting is essential to upholding monetary integrity.

Roles in forensic accounting, resembling Fraud Examiner, Forensic Accountant, and Forensic Auditor, provide aggressive salaries, ranging roughly from $60,960 to $74,756 within the U.S. The formation of the Large 4 accounting corporations was influenced by main accounting scandals, underscoring the very important position of forensic accountants in selling integrity in monetary reporting.

The mixing of blockchain expertise in forensic accounting holds the promise of mitigating fraud and enhancing the transparency of economic transactions. Acquiring a Licensed Fraud Examiner (CFE) certification can additional bolster the credentials of forensic accountants.

Accounting Roles Throughout Industries

Varied sectors resembling public accounting corporations, authorities companies, and non-profits current alternatives for various kinds of accounting professionals. Every {industry} provides distinctive roles and obligations, catering to completely different pursuits and talent units. This selection empowers accountants to delve into various kinds of accounting profession paths, and uncover the area of interest that aligns finest with their strengths and preferences.

The next subsections will delve into the precise roles and obligations of accountants within the following sectors:

- Public accounting

- Non-public and company accounting

- Authorities accounting

- Non-profits

Every of those areas current distinct challenges and alternatives.

Public Accounting

Public accounting includes offering accounting recommendation to purchasers based mostly on their wants, encompassing:

- Auditing

- Tax accounting

- Know-how set up procedures

- Authorized recommendation & litigation assist

Working in accounting corporations that serve a number of purchasers, public accountants usually think about getting ready tax returns and dealing with tax funds for various entities. Many public accountants, particularly Licensed Public Accountants (CPAs), have their very own companies or work for public accounting corporations.

To turn into a Licensed Public Accountant, a person should move the CPA exams, full further training items, and achieve expertise working beneath a licensed CPA. Whereas this certification is elective for public accountants, it’s obligatory for personal accountants.

Along with offering quite a lot of companies within the accounting discipline, public accountants work with a number of purchasers throughout industries, offering a broad perspective and various expertise. This selection makes public accounting an thrilling and dynamic discipline.

Non-public and Company Accounting

Working in-house for particular corporations, personal and company accountants typically choose to concentrate on explicit industries like eating places, logistics corporations, or legislation corporations. These accountants concentrate on the monetary operations of their respective organizations, guaranteeing compliance with accounting requirements and offering monetary insights to assist enterprise choices.

Company accountants play a crucial position in managing monetary information, getting ready monetary studies, and overseeing inner audits. Continuously, they companion with different departments to ensure correct monetary reporting and strategic planning. This in-house position permits accountants to develop deep industry-specific experience and contribute on to their group’s success.

Authorities Accounting

Because of stricter laws and particular public cash administration necessities, authorities accounting is significantly extra complicated and detailed than personal sector accounting. Accounting jobs for federal, state, and native governments contain duties and roles resembling:

- inner auditors

- monetary accounting

- danger advisory

- data assurance

Authorities accountants play an important position in guaranteeing that public funds are managed responsibly and transparently. They need to adhere to stringent laws and requirements, resembling these set by the Governmental Accounting Requirements Board (GASB). This accountability makes authorities accounting a difficult however rewarding profession path for these considering public service.

Accounting for Non-Earnings

In non-profit organizations, accountants perform very important monetary duties like monetary accounting and bookkeeping, grant administration, and budgeting. These duties be sure that non-profits can successfully handle their assets and obtain their mission-driven objectives.

Grant administration and reporting are notably necessary in non-profit accounting, as these organizations typically depend on grants and donations for funding. Correct budgeting and forecasting are additionally essential to make sure that non-profits can plan for the longer term and make knowledgeable monetary choices.

This distinctive concentrate on mission-driven monetary administration makes non-profit accounting a satisfying profession alternative.

Key Expertise for Fashionable Accountants

To excel of their roles and adapt to the altering career, fashionable accountants require a mixture of technical and mushy expertise. Proficiency in accounting software program resembling QuickBooks, Excel, and Google Workspace is important for technical accounting duties. Accountants should additionally make sure the reliability of economic transactions and data, requiring crucial pondering to resolve complicated issues involving errors, discrepancies, and inaccuracies.

Accountants will need to have the next expertise:

- Efficient communication expertise to obviously current technical monetary data and foster productive relationships with purchasers

- Time administration expertise, as accountants typically have strict deadlines and intensive shopper commitments

- Glorious organizational expertise, with consideration to element

- Analytical proficiency, particularly within the areas of math and enterprise

- Information concerning the newest expertise, cybersecurity measures, and accounting requirements for profession development

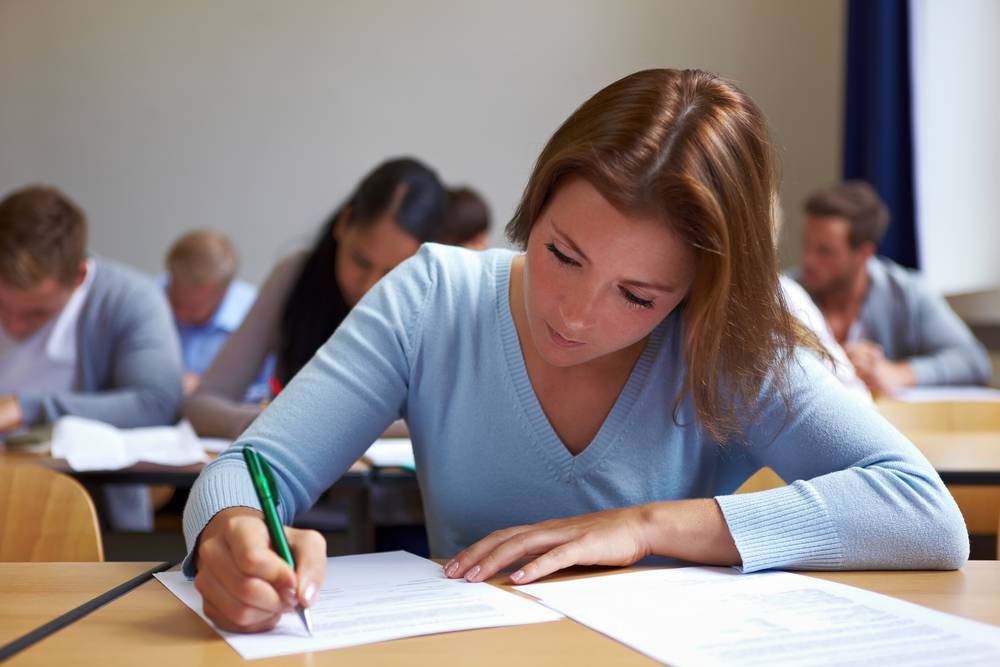

Certifications That Elevate Your Accounting Profession

Incomes skilled certifications can considerably improve an accountant’s profession prospects and incomes potential. Turning into a Licensed Public Accountant (CPA) is without doubt one of the most acknowledged certifications within the discipline, requiring 150 hours of training, documented expertise, and passing the Uniform CPA Examination. The CPA credential opens doorways to higher-level positions and higher job safety.

Different priceless certifications embody:

- Licensed Administration Accountant (CMA): solidifies experience in monetary administration and technique

- Licensed Inside Auditor (CIA): makes a speciality of inner auditing

- Chartered World Administration Accountant (CGMA): focuses on managerial accounting

- Licensed Authorities Monetary Supervisor (CGFM): makes a speciality of authorities finance

These certifications develop professionals’ talent units and enhance their incomes potential, making them essential instruments for profession development.

Know-how’s Impression on Accounting Jobs

Technological strides like cloud computing and digital doc administration have reworked the accounting career, selling effectivity and accuracy within the efficiency of duties by accountants. Experience in complicated software program like SAP ERP and Oracle Financials is more and more in demand. Automation is dealing with extra routine duties, permitting accountants to concentrate on crucial pondering and problem-solving, and making room for roles like monetary analysts.

Rising applied sciences like blockchain and synthetic intelligence are set to additional rework the accounting panorama, resulting in elevated expectations of accuracy and effectivity from accounting professionals. Skilled improvement packages now continuously incorporate coaching in superior monetary software program, information analytics instruments, and automation expertise, guaranteeing that accountants keep up-to-date on this quickly evolving discipline.

Pathways to a Profitable Accounting Profession

A sturdy educational basis is the start line of a profitable accounting profession. Aspiring accountants ought to pursue courses in:

- Math

- Pc science

- Economics

- Statistics

- Enterprise

Acquiring a bachelor’s diploma in accounting or a associated discipline is usually required for many entry-level accounting positions. Palms-on expertise can also be very important, achievable by means of internships or entry-level positions resembling bookkeeper or accounts payable specialist.

Grasp of Accounting (MACC) packages with specializations can additional improve private {and professional} improvement. Networking and using on-line assets resembling job boards {and professional} networks are efficient strategies for figuring out profession alternatives in accounting. Constructing job-ready expertise by means of on-line programs primes aspiring accountants for fulfillment.

Wage Expectations in Accounting

Accounting is a rewarding profession, providing not simply job satisfaction but additionally aggressive salaries. New accountants can count on to earn above $50,000 a yr, with potential for increased salaries for these possessing a grasp’s diploma or CPA certification. Inside 5 to seven years of commencement, accountants with a grasp’s diploma typically progress to six-figure salaries.

Specialised roles resembling CPA, Auditor, and Tax Advisor have various salaries, with CPAs incomes a median of $83,308, Auditors at $52,697, and Tax Advisors at $63,439. Administration accounting roles like Monetary Controller, Administration Accountant, and Monetary Analyst additionally provide substantial earnings, with salaries of $99,555, $91,583, and $69,196 respectively.

General, accounting supplies a satisfying profession path with a snug median wage of $78,000 and robust job safety.

Navigating the Job Market: Discovering Your Match

Efficient navigation of the efficient navigation of the job market to securing the precise accounting position. Listed below are some suggestions that will help you:

- Create a well-tailored resume that highlights your expertise, certifications, areas of experience, and particular accomplishments.

- Customise the resume abstract for every place by pinpointing expertise and achievements that resonate with the employer’s necessities.

- Take into account using a hybrid structure with talent units adopted by work historical past.

By following the following tips, you possibly can enhance your possibilities of touchdown the accounting job you want.

Demonstrating versatility by means of various work experiences resembling internships, volunteer actions, and golf equipment can showcase transferable expertise. Together with job-specific key phrases within the expertise record can improve the resume’s visibility on on-line job platforms. After submitting an utility, following up with a short and courteous e-mail or telephone name inside a fortnight can reiterate curiosity within the accounting position.

Charting Your Progress: Profession Progress in Accounting

In accounting, profession development can progress from entry-level positions to specialised roles and ultimately, government management. Accountants usually begin as employees accountants and should progress to managerial and government roles like finance director or CFO by demonstrating experience in technical expertise, management, and enterprise data. Entry-level jobs, internships, and roles resembling bookkeeping function very important stepping stones for networking, skill-building, and profession development in accounting.

Steady studying is important for transitioning between subfields inside accounting, resembling from auditing to monetary evaluation or consulting roles. Accountants can rise by means of the ranks to positions like inner auditors, chief monetary officer (CFO), or board director, making accounting a discipline with substantial development potential.

Balancing Work and Examine: Persevering with Schooling in Accounting

For accountants to remain aggressive and advance their careers, persevering with training is important. Staying knowledgeable about new laws, applied sciences, and enterprise practices helps accountants adapt to adjustments within the career. Steady studying enhances profession alternatives, making professionals extra engaging candidates for promotions and higher-paying roles.

Networking alternatives by means of seminars, workshops, consumer teams, and conferences are integral components of constant accounting training. By participating in steady skilled improvement, accountants can develop superior expertise in monetary evaluation, strategic planning, and danger administration. This ongoing training ensures that accountants keep a aggressive edge and are well-equipped to deal with the evolving calls for of the career.

The World Stage: Worldwide Alternatives in Accounting

With quite a few worldwide alternatives, accounting permits professionals to journey for work-related duties like audits, consulting, or tax-related actions. Working internationally can present priceless expertise and broaden an accountant’s understanding of world monetary practices and laws.

Adapting to worldwide monetary reporting requirements and understanding various cultural and regulatory environments are essential for accountants working overseas. The potential for journey and world experiences makes accounting an thrilling discipline for these trying to develop their horizons and achieve a broader perspective on monetary administration.

Abstract

In abstract, the accounting career provides a various vary of profession alternatives throughout numerous industries. From monetary accounting to administration accounting and forensic accounting, every specialization supplies distinctive challenges and rewards. The demand for accounting professionals continues to develop, underscoring the significance of accounting training and certifications in enhancing profession prospects and incomes potential.

As expertise continues to rework the accounting panorama, staying knowledgeable and adaptable is essential for fulfillment. By pursuing steady training {and professional} improvement, accountants can stay aggressive and advance their careers. The potential for worldwide alternatives additional provides to the attraction of this dynamic and rewarding career. Embarking on an accounting profession guarantees a future full of development, studying, and success.

Continuously Requested Questions

What technical expertise do accountants want?

Accountants must be proficient in fundamental technical accounting expertise and keep updated with present finest practices within the discipline. They need to even have data of accounting software program resembling QuickBooks, Excel, and Google Workspace to excel of their roles.

What’s the significance of getting ready and reporting on monetary statements for accountants?

Making ready and reporting on monetary statements is essential for accountants as they’re accountable for creating, monitoring, and reporting on steadiness sheets, revenue statements, and money circulate statements. It’s a crucial a part of their position.

What mushy expertise are necessary for accountants?

Delicate expertise like communication, time administration, group, crucial pondering, problem-solving, and a spotlight to element are necessary for accountants. They assist accountants construct sturdy relationships, handle duties successfully, suppose critically, resolve issues, and take note of element.

What expertise do accounting corporations search for in job candidates?

Accounting corporations search for a mixture of arduous and mushy expertise in job candidates, together with familiarity with spreadsheets, commonplace accounting software program, and Typically Accepted Accounting Ideas, in addition to sturdy communication, time administration, and a spotlight to element. So, showcasing a mix of technical and non-technical expertise in your utility and through interviews can considerably increase your possibilities of touchdown a job at an accounting agency.